Core prompt:The potential and challenges of the Chinese organic marketFor years there were no official figures available for

The potential and challenges of the Chinese organic market

For years there were no official figures available for the organic market in the People's Republic of China, even though this huge country has for a long time been supplying a lot of organic products. Organically managed land, the volume of production and organic consumption have grown strongly in recent years and have, according to the data we now have access to, catapulted China into fourth place in the worldwide ranking of organic markets. Karin Heinze has been travelling in China and at BioFach in Shanghai she spoke to the chairman of IFOAM-Asia Zhou Zheijang and Markus Arbenz, the managing director of IFOAM Organics International.

China should not be underestimated as a producer of organic raw materials

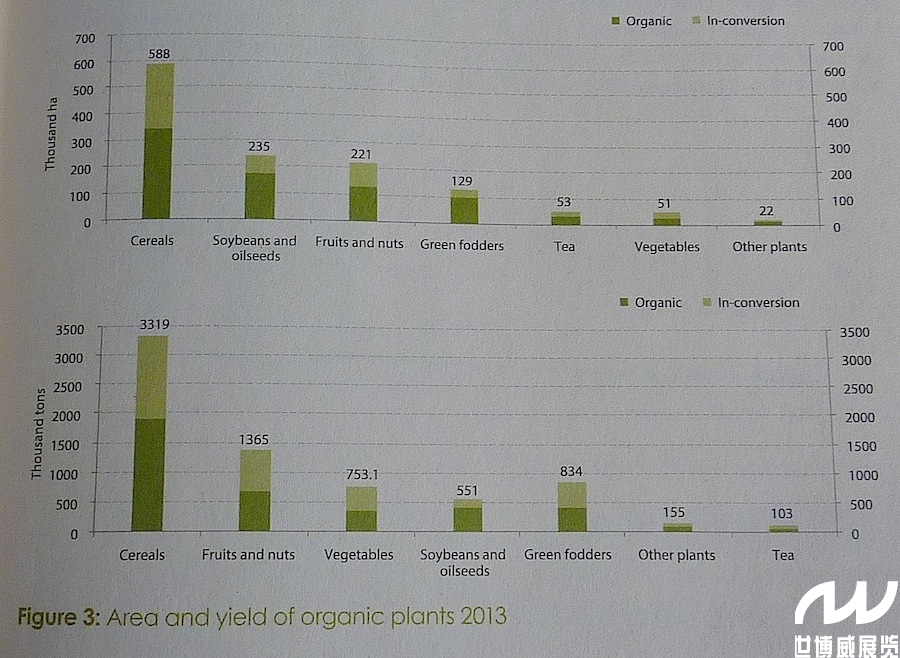

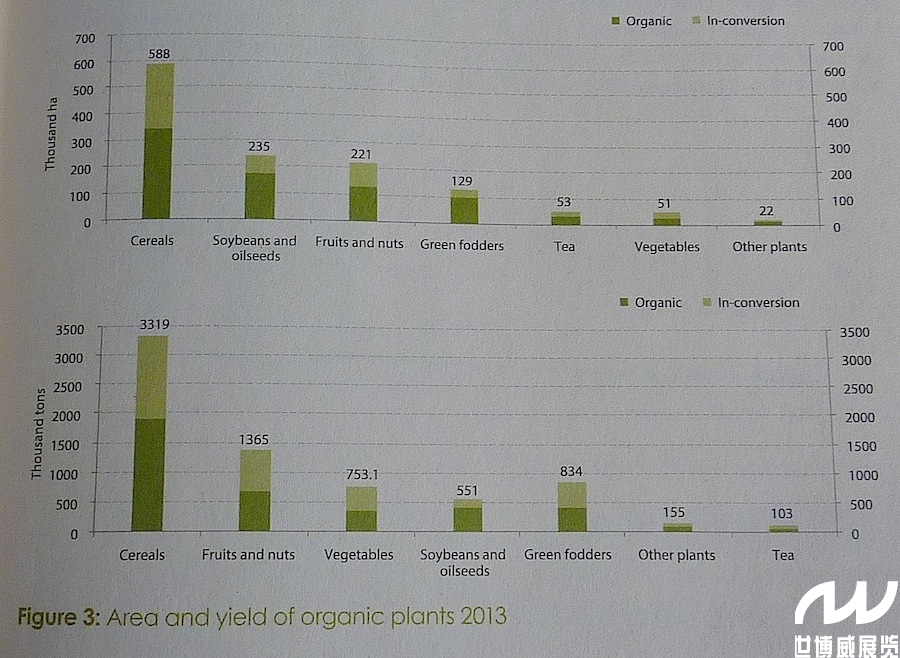

China's organic market is growing dynamically. “Don't forget China on the organic map,“ says IFOAM Worldboard and IFOAM-Asia CEO Zhou Zhejiang. You realise he's fully justified in saying that when you look at the figures and see just how quickly the market is developing: according to the market report “Organic Industry Development Report of China" in 2013, almost 10 million tonnes of organic goods were produced in China, approximately 7 million for the domerstic market and the rest for export (around 600,000 tonnes from wild collection). This volume was produced on a good 3.5 million hectares – nearly one percent of the total agricultural land in China. Most organic production is concentrated in the north-eastern provinces and on the coast (for example, Heilongjiand, Shandong and Zhejiang). In recent yerars, organic production in the north-western provinces like Sichuan, Guizhou and Inner Mongolia has been growing apace.

All organic land is cultivated in compliance with the guidelines in China's organic legislation, with 1.435 million ha belonging to the wild collecting category. If we look at the details, according to official sources,* at the end of 2013 1.287 million hectares were controlled by Chinese certification organisations and 807,000 ha by foreign certifiers. In total, nearly 10,000 certificates were issued. The authorised foreign certification organisations are Ecocert China, Ceres, IMO and BCS (KIWI).

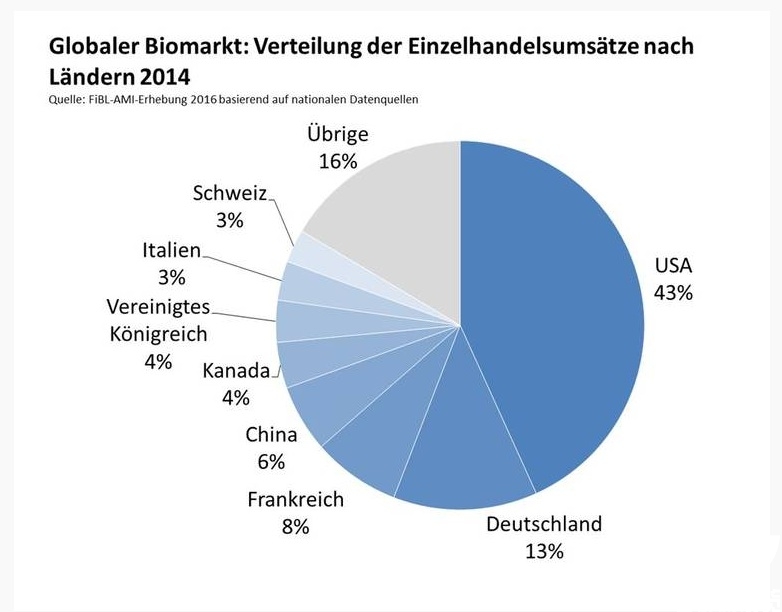

Export markets: USA and Germany are among the major buying countries

According to the market report, compared with 2010, exports as a proportion of sales grew by 19.5 % to US$250m, and growth in volume was 41 %, rising to 246,000 tonnes. The top ten countries receiving exports from China – business worth almost US$195m – include the USA (45 million), Germany, Netherlands, Canada, Japan, Switzerland, Belgium, Britain and France. The major export products are soya and other beans (ca.US$67m), followed at a much lower level by tea, fruit, nuts and vegetables, each generating around US$22m, and cereals (ca. US$16m).

In order to increase the selection of processed organic products on the Chinese market and to take account of rising demand, more than 50 international companies have taken the initiative and export to China to exploit the potential that is undoubtedly present in the country. Examples are the Danish dairies Arla and Thise, and Verival and Zotter in Austria.

Future: Ambitious aims

If it goes according to plan, the area of organically managed land in China will constitute 1.2 to 1.5 % of total agricultural land by 2020 and China will become the leading producer of organics worldwide. Market analysts forecast a share of up to 3 % in the domestic food market and a share of 1-1.5 % of exports. A current market report by the Indian market research company Ken Research - “China Organic Food Market Outlook to 2020“ - forecasts great potential in the Chinese organic market and strongly growing turnover. The reasons perceived by the market researchers are the fact that people are increasingly concerned about food safety and a rapidly developing middle class that is well educated and financially in a position to afford organic products. The report also says that the commitment of big firms that are becoming involved in organic production and marketing are playing an important role. It gives the example of the two big dairies Yili and Mengniu that were responsible for a substantial share of organic turnover in 2015.

FiBL is intensifying its involvement in China

The Swiss Research Institute of Organic Agriculture (FiBL) has been active in China for 20 years in procurement and consulting projects, explained FiBL Director Urs Niggli during a visit by the Chinese ambassador Wenbing Geng to Frick. In contrast, FiBL's cooperation with the Institute for Genetics and Development Biology (IGDB) in Peking, an institute of the Chinese Academy of Sciences( CAS) and other institutes in the Shanghai region, is a new venture.